As a small business owner, there may be times when you need quick access to funding. Whether it’s for unexpected expenses, cash flow challenges, or growth opportunities, having access to fast financing can be crucial for the success of your business.

Toc

That’s where same day business loans come in. These types of loans are designed to provide small businesses with immediate access to capital so they can take advantage of time-sensitive opportunities and keep their operations running smoothly.

In this guide, we’ll explore the ins and outs of same day business loans, including what they are, how they work, and how you can qualify for one. We’ll also discuss the pros and cons of these types of loans so you can determine if they’re the right fit for your business.

Introduction to Same Day Business Loans

Same day business loans are a type of financing that provides small businesses with access to funds on the same day they apply. This means you can receive the money you need in a matter of hours, rather than waiting weeks or even months for traditional lenders to approve and disburse funds.

What are Same Day Business Loans?

Same day business loans, also known as instant or quick business loans, are a type of financing that allows small businesses to access capital within 24 hours. These loans are typically unsecured, meaning you don’t need to provide collateral such as assets or property in order to qualify.

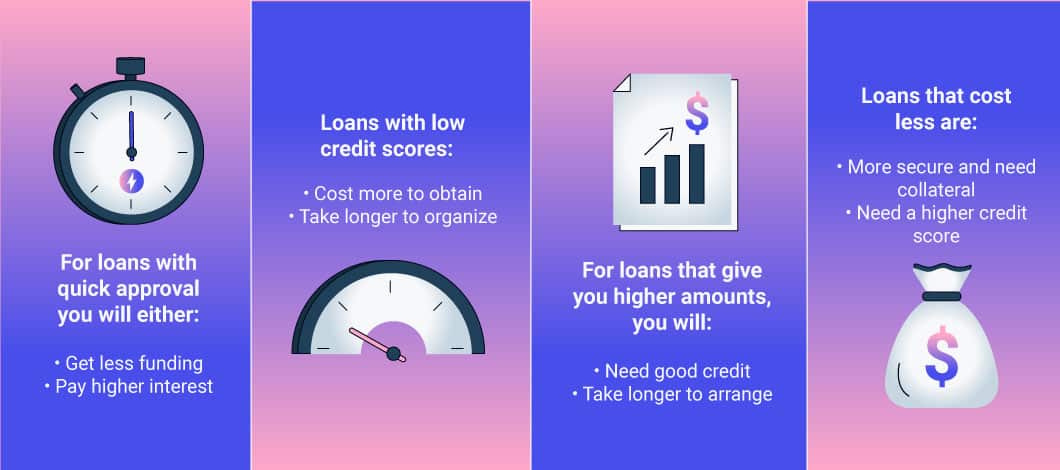

In most cases, same day business loans have a fast application and approval process. This is because lenders understand the urgency of these types of loans and aim to provide funding as quickly as possible. As a result, same day business loans may have higher interest rates compared to traditional bank loans.

There are various types of same day business loans, including lines of credit, invoice financing, and short-term loans. Each type has its own features and requirements, so it’s important to understand the differences before deciding which one is right for your business.

How Do Same Day Business Loans Work?

The application process for same day business loans is typically quick and straightforward. Most lenders offer an online application where you can provide basic information about your business and financing needs. You may also need to submit financial documents such as tax returns or bank statements.

Once your loan application is submitted, the lender will review it and make a decision within a few hours or by the end of the day. If approved, the funds can be deposited into your business account within 24 hours.

Repayment terms for same day business loans vary depending on the type of loan and lender. Some loans may require daily or weekly payments, while others may have monthly payments. It’s important to carefully review the terms and conditions of the loan before accepting the funds to ensure you can comfortably make the payments.

Importance and Benefits of Same Day Business Loans

Same day business loans can be a valuable tool for small businesses, providing them with quick access to funding when they need it the most. Here are some of the key benefits of these types of loans:

Why Immediate Funding Matters

For small businesses, cash flow is king. Unexpected expenses or sudden opportunities can arise at any moment, making immediate access to funds crucial. Same day business loans allow businesses to:

- Take advantage of growth opportunities: Quickly purchase inventory, hire new staff, or expand operations.

- Manage emergencies: Address urgent repairs or unexpected costs without disrupting operations.

- Maintain cash flow: Ensure smooth operations during periods of fluctuating revenue.

Pros and Cons of Same Day Business Loans

Like any type of financing, same day business loans have their advantages and disadvantages. It’s important to carefully consider these factors before deciding if a same day business loan is the right choice for your business.

Pros:

- Fast access to funds: As the name suggests, same day business loans provide businesses with immediate access to capital, which can be crucial in certain situations.

- Less stringent requirements: Compared to traditional bank loans, same day business loans may have less strict eligibility requirements and may not require collateral.

- Flexible repayment terms: Depending on the lender and type of loan, you may have flexible repayment options that fit your cash flow needs.

Cons:

- Higher interest rates: Due to the quick turnaround and higher risk for lenders, same day business loans may have higher interest rates compared to traditional loans.

- Potential for debt cycles: If not managed carefully, taking out multiple short-term loans can lead to a cycle of debt that can be difficult for small businesses to break out of.

Direct Benefits

- Speed and Convenience: Funds are often available within hours, allowing swift action.

- Flexibility: Loans can be tailored to meet specific business needs.

- No Long Waits: Bypass lengthy approval processes typical of traditional loans.

Eligibility and Application Process

To qualify for a same day business loan, you’ll need to meet certain eligibility criteria. These may vary depending on the lender and type of loan, but here are some common requirements:

Typical Eligibility Criteria

To qualify for a same day business loan, most lenders look for:

- A good credit score: Typically, a score of 600 or above.

- Stable revenue: Demonstrates the ability to repay the loan.

- Time in business: Usually at least 6 months to 1 year.

In addition to these basic requirements, lenders may also consider your industry, cash flow, and business plan when making a decision.

Application Process

The application process for same day business loans is usually quick and streamlined. Here are the general steps you can expect:

- Gather necessary documents: This may include financial statements, tax returns, and proof of identity.

- Fill out an online application: Provide information about your business and financing needs.

- Submit your application: Once submitted, the lender will review it and make a decision within a few hours or by the end of the day.

- Receive funds: If approved, the funds will be deposited into your business account within 24 hours.

Top Same Day Business Loan Providers

- BlueVine: Known for high loan amounts and flexible repayment terms.

- OnDeck: Offers a fast online application process and lower credit score requirements.

- Kabbage: Provides an easy-to-use platform with ongoing line-of-credit access.

|

Provider |

Interest Rates |

Loan Amounts |

Key Features |

|---|---|---|---|

|

BlueVine |

4.8% – 51% APR |

Up to $250,000 |

High loan amounts, flexible terms |

|

OnDeck |

9% – 99% APR |

Up to $500,000 |

Fast application, lower credit |

|

Kabbage |

1.25% – 10% |

Up to $250,000 |

Easy platform, line of credit |

Choosing the Right Lender for Same day Business loan

When considering a same day business loan, it’s crucial to select a lender that aligns with your financial needs and business goals. Each lender has unique offerings, interest rates, and repayment structures, so it’s important to conduct thorough research. Here are a few factors to consider while choosing the right lender:

- Reputation and Reviews: Look for lenders with positive reviews from other business owners. Testimonials can provide insight into the lender’s reliability and customer service.

- Transparency of Terms: Ensure that all terms and conditions are clearly explained, with no hidden fees. A reputable lender should provide straightforward information regarding interest rates, repayment schedules, and any associated costs.

- Customer Support: Strong customer service can make a significant difference in your lending experience. Choose a lender that offers accessible support channels, should you have any questions or concerns throughout the loan process.

- Flexibility in Loan Use: Some lenders have restrictions on how the loan funds can be used. Ensure that the lender you choose allows for loans that meet the specific needs of your business.

Taking the time to evaluate these factors can significantly impact your financing experience and help you secure a loan that effectively supports your business objectives.

Tips for Choosing the Right Same Day Business Loan

- Assess Your Needs: Determine how much you need and how quickly you can repay.

- Compare Providers: Look at interest rates, terms, and customer reviews.

- Understand the Costs: Be aware of any hidden fees and the total cost of the loan.

- Seek Professional Advice: Consult a financial advisor to ensure the loan aligns with your business strategy.

- Read the Fine Print: Carefully review and understand all terms and conditions before committing to a loan.

Top Same Day Business Loan Providers in the US 2024

As the landscape of financing options continues to evolve, several lenders have emerged as leaders in the same day business loan sector for 2024. Here’s an overview of some of the top providers that businesses can consider for quick financing solutions:

- Fundbox: Offering a fast and straightforward application process, Fundbox allows businesses to access credit lines with minimal paperwork. Their credit score requirements are comparatively low, making it accessible for newer businesses as well.

- Funding Circle: As a peer-to-peer lending platform, Funding Circle connects small businesses with investors. While they focus on slightly longer repayment terms, their approval process remains swift, facilitating quick funding options.

- StreetShares: This provider stands out for its dedication to veteran-owned businesses and offers competitive rates and flexible terms tailored to the needs of smaller enterprises. Their application process is efficient, making it an appealing choice for quick access to funds.

- Lendio: With a network of multiple lenders, Lendio provides a one-stop-shop for comparing different financing options. Their service helps business owners quickly identify the best same-day loan products based on their unique requirements.

Success Stories and Testimonials

Successful Stories with Same Day Business Loan

There are several success stories of businesses that have utilized same day business loans to achieve their objectives. For example:

- Brew City Marketing: This company used a same day loan to fund an expansion and increase its workforce, resulting in significant growth.

- The Nellie Mae Boutique: After Hurricane Harvey devastated their store, this boutique received a same day business loan that allowed them to rebuild quickly and continue serving their community.

- Salty Sweet: This bakery utilized a same day loan to upgrade their equipment and expand their product offerings, leading to increased profits and customer satisfaction.

Testimonials

To further highlight the benefits of same day business loans, here are a few success stories from satisfied borrowers:

- “Thanks to BlueVine’s same-day loan, we were able to secure the necessary funds for our business expansion within 24 hours. The flexible repayment terms allowed us to comfortably manage our cash flow while taking our business to the next level.” – John Smith, Small Business Owner.

- “After being turned down by traditional lenders due to my credit score, I was relieved to find OnDeck’s same day loan option. Their streamlined application process and quick decision-making allowed me to receive funding on the same day without any hassle.” – Sarah Jones, Freelancer.

These testimonials showcase how same day business loans have helped businesses overcome financial obstacles and achieve their goals. As the demand for quick financing solutions continues to grow, more lenders are offering same day business loans to cater to this need. By carefully researching and selecting the right lender, businesses can take advantage of these convenient and efficient funding options. So, it is important to keep in mind the above-mentioned factors while choosing a same day business loan provider and make an informed decision that will benefit your business in the long run.

Conclusion

In conclusion, same day business loans present a valuable solution for entrepreneurs in urgent need of financial support. By understanding the key factors to consider when selecting a lender, such as reputation, transparency of terms, customer support, and loan flexibility, business owners can increase their chances of securing a loan that aligns with their specific needs. Moreover, as evidenced by numerous success stories and testimonials, these loans have empowered many businesses to flourish even in challenging circumstances. As the lending landscape continues to evolve, staying informed and making data-driven decisions will be essential in leveraging these quick financing options to foster growth and stability in the ever-changing business environment.