When considering how to finance your education, it’s important to explore all of your options. Scholarships and grants are a great way to reduce the cost of tuition, but they may not cover all of your expenses. That’s where loans come in.

Toc

One type of loan that can be especially useful for students is the Direct Unsubsidized Loan. These loans are available through the U.S. Department of Education and do not require a credit check or cosigner. This makes them an accessible option for many students who may not have established credit yet.

But what exactly is a Direct Unsubsidized Loan and how does it work? Let’s dive into the details.

Introduction to Direct Unsubsidized Loans

Navigating the financial aspects of college can be daunting, especially when it comes to understanding student loans. One common yet essential option for many college students is the Direct Unsubsidized Loan. This article aims to provide a comprehensive guide on Direct Unsubsidized Loans, helping students make informed decisions about financing their education.

What is a Direct Unsubsidized Loan?

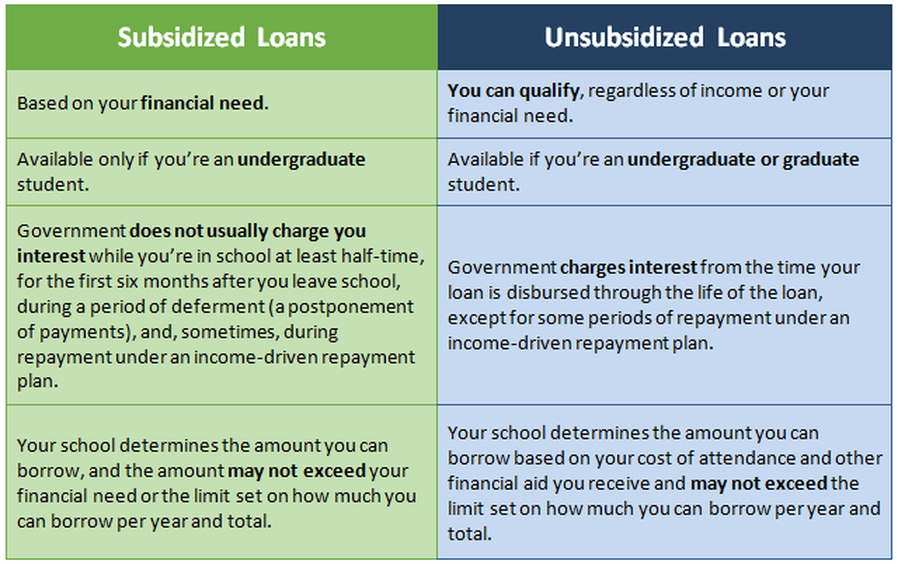

A Direct Unsubsidized Loan is a federal student loan available to both undergraduate and graduate students. Unlike subsidized loans, interest on Direct Unsubsidized Loans starts accruing from the time the loan is disbursed. Here are some key features:

- Interest Accrual: Interest begins to accumulate as soon as the loan is disbursed.

- Eligibility: Available to all eligible students regardless of financial need.

- Loan Limits: Annual and aggregate loan limits depend on the student’s year in school and dependency status. These limits are higher for graduate students.

- Origination Fee: A small percentage of the loan amount is deducted as an origination fee. The current fee for Direct Loans is 1.057% (valid until September 30, 2021).

- Repayment Options: Students can choose from various repayment plans, including Standard Repayment, Graduated Repayment, and Income-Driven Repayment.

Now that we have a basic understanding of what a Direct Unsubsidized Loan is let’s look at some of its advantages and disadvantages.

Pros of Direct unsubsidized loan

- No Credit Check or Cosigner Required: Eligibility for a Direct Unsubsidized Loan does not depend on credit history or the need for a cosigner, making it accessible to many students.

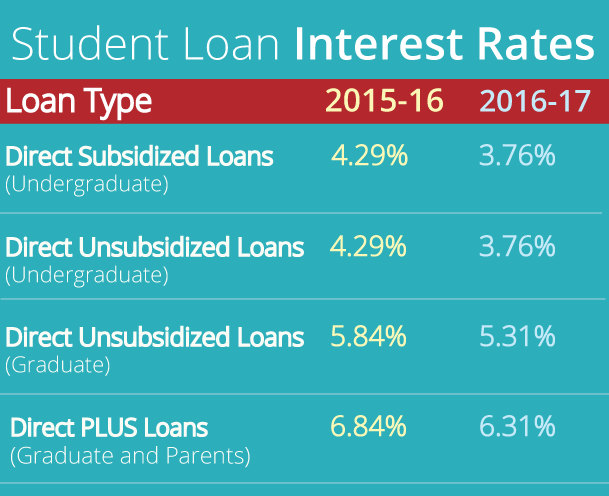

- Lower Interest Rates: The interest rates for Direct Unsubsidized Loans are fixed and typically lower than private student loans.

- Flexibility in Repayment Plans: As mentioned earlier, there are various repayment options available, providing flexibility for students to choose a plan that works best for them.

Cons of Direct unsubsidized loan

- Interest Accrues During School and Grace Periods: Unlike subsidized loans where the government pays the interest during certain periods, with Direct Unsubsidized Loans, interest accrues throughout the life of the loan.

- Loan Limits May Not Cover All Expenses: Depending on your school’s cost of attendance

Eligibility Criteria for College Students

To qualify for a Direct Unsubsidized Loan, students must meet certain eligibility requirements. These criteria ensure that the loans are provided to those who are genuinely seeking to further their education. Here are the key eligibility factors to consider:

Enrollment Status

To be eligible for a Direct Unsubsidized Loan, students must be enrolled at least half-time in an eligible degree or certificate program at a participating institution. This means that students need to be taking a sufficient number of credit hours each semester to maintain their status, which varies by school but is generally defined as at least six credits for undergraduate programmes and typically more for graduate programmes. It’s essential for students to check with their school’s financial aid office to confirm specific enrollment requirements and ensure they meet them throughout their studies.

Citizenship and Residency

Another key criterion is that students must be U.S. citizens or eligible non-citizens. This includes permanent residents with a Green Card. Additionally, applicants may be asked to provide documentation of their residency status, reinforcing the need for clarity and transparency in the application process.

Completing the FAFSA

To receive a Direct Unsubsidized Loan, students must complete the Free Application for Federal Student Aid (FAFSA). This application not only assesses eligibility for federal loans but also helps determine eligibility for various grants and scholarships, further aiding in funding education. It’s advisable to submit the FAFSA as early as possible to maximize aid opportunities and adhere to any deadlines set by the institution.

By understanding these eligibility criteria, students can better navigate the loan application process and secure the financial assistance they need for their educational journey.

Choosing a Repayment Plan for Direct Unsubsidized Loans

As mentioned earlier, Direct Unsubsidized Loans offer various repayment plans for students to choose from. These plans differ in terms of monthly payments and length of time to repay the loan. It’s important to research and understand each plan’s details before making a decision. Some factors to consider when choosing a repayment plan include:

Monthly Payments

The monthly payment amount will depend on the repayment plan chosen, the total loan amount, and the interest rate. Generally, under the Standard Repayment Plan, borrowers pay a fixed amount over a period of 10 years, allowing for predictable budgeting. In contrast, the Graduated Repayment Plan starts with lower payments that gradually increase, making it an appealing option for graduates expecting their earnings to rise over time. For those with variable incomes, Income-Driven Repayment plans could be advantageous, as they adjust monthly payments based on discretionary income and family size. Understanding the implications of each plan is crucial, as it can significantly affect long-term financial stability and the overall cost of the loan.

Loan Forgiveness Opportunities

An added consideration when selecting a repayment plan is the potential for loan forgiveness. Under certain circumstances, such as working in public service or qualifying for specific income-driven repayment plans, borrowers may become eligible for loan forgiveness after making a set number of qualifying payments. Programs like Public Service Loan Forgiveness (PSLF) offer paths to forgiveness, but they require careful documentation and adherence to specific criteria. Students should explore these options early on to factor them into their repayment strategy, ensuring they navigate their student loan responsibilities with foresight and planning.

Total Loan Amount

The total loan amount that students can borrow through Direct Unsubsidized Loans depends on various factors, including their year in school and dependency status. For undergraduate students, annual loan limits generally range from $5,500 to $12,500, while graduate students can borrow up to $20,500 per year. Additionally, the cumulative borrowing limit for undergraduate students is capped at $57,500, and for graduate students, the total limit is $138,500, including any federal loans received for undergraduate studies. Understanding these limits is essential for students to effectively budget their educational expenses, as exceeding these caps may require students to seek alternative funding sources, such as private loans or scholarships. It’s advisable to regularly check with financial aid offices to stay informed about any adjustments to these limits and to plan finances accordingly.

Job Stability

A significant factor influencing a student’s ability to repay their Direct Unsubsidized Loans is job stability post-graduation. Entering a field with strong demand for skilled workers can lead to better job security and higher earning potential, thereby easing the burden of student loan debt. Additionally, industries that offer robust entry-level positions often provide opportunities for advancement and salary increases over time, enabling borrowers to manage their loan payments more effectively. It is beneficial for students to consider job market trends in their chosen field and pursue internships or co-op programs during their studies, as these experiences can enhance employability and lead to promising job offers after graduation. Moreover, building professional relationships and networking during academic years can play a crucial role in securing stable employment, ultimately contributing to a sustainable repayment strategy for their student loans.

Interest Rate Changes

Understanding how interest rates can change is vital for managing Direct Unsubsidized Loans effectively. While the interest rates for these federal loans are fixed for the life of the loan, it’s important to monitor any changes that may occur for new loans each academic year. Congress typically reviews and sets the rates annually, which means that students borrowing in a different financial year may face different rates. This can significantly affect budgeting and repayment strategies, particularly for students who are taking out multiple loans over their educational journey. Staying informed about these fluctuations can help prospective borrowers plan ahead and make informed decisions about their financing. Additionally, students considering private loans should be aware that interest rates for those loans can fluctuate more dramatically, often depending on credit scores and market conditions, which adds another layer of complexity to financial planning.

Comparison of Direct Unsubsidized Loans with Other Types of Student Loans

While Direct Unsubsidized Loans are a common choice for students seeking federal financial aid, it’s essential to understand the differences between these loans and other types of student loans. When considering student loans, it’s essential to understand the differences between various options:

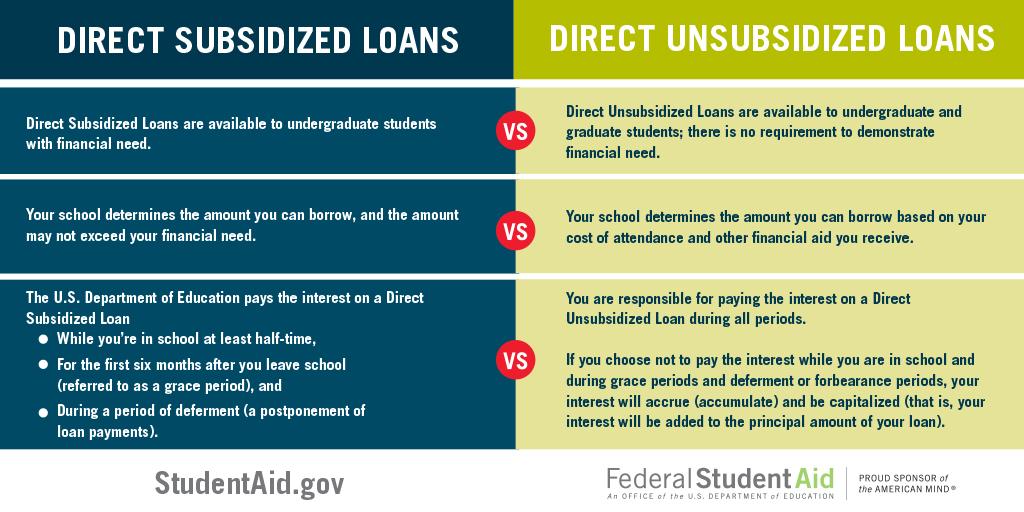

Direct Subsidized vs. Direct Unsubsidized Loans

Subsidized:

- Interest is subsidized by the government.

- Only available to undergraduates who demonstrate financial need.

- No accruing of interest while in school and during deferment periods.

- Annual loan limits are lower than those for Direct Unsubsidized Loans.

Unsubsidized:

- Interest is not subsidized by the government.

- Available to both undergraduates and graduates regardless of financial need.

- Interest accrues while in school and during deferment periods.

- Higher annual loan limits than Direct Subsidized Loans.

Understanding these differences can help students make informed decisions about which type of loan best suits their needs. For example, if a student does not demonstrate significant financial need, they may not be eligible for a Direct Subsidized Loan but could still qualify for a Direct Unsubsidized Loan. In that case, they should carefully consider the potential for accruing interest and factor it into their repayment strategy.

Federal vs. Private Loans

Federal Student Loans are funded by the government, while private student loans are provided by banks or credit unions. While federal loans generally offer more flexible repayment options and fixed interest rates, private loans may have higher borrowing limits and potentially lower interest rates depending on a borrower’s credit score. However, it’s essential to note that private loans typically do not offer the same level of borrower protections and forgiveness opportunities as federal loans, making them a riskier option in terms of long-term financial planning. Ultimately, students should weigh the pros and cons of each type of loan and consider their specific financial situation before deciding which option is best for them.

Parent PLUS Loans

- Borrowed by parents to help pay for their child’s education.

- Higher interest rates and borrowing limits than Direct Unsubsidized Loans.

- Requires a credit check.

- Repayment begins immediately after disbursement.

Parent PLUS Loans can be a viable option for parents looking to help their child fund their education. However, it’s essential to consider the potential impact on both the student and parent’s credit and financial stability. Additionally, parents should carefully consider whether they have the means to repay the loan before taking on this responsibility.

Private Student Loans

- Offered by private lenders and banks.

- Often require a co-signer and credit check.

- Typically have higher interest rates and fewer repayment options compared to federal loans.

While private student loans can provide additional funds for education, they carry more significant risks and may not offer the same level of borrower protections as federal loans. It’s essential to carefully research and compare different loan options before making a decision. Ultimately, students should aim to minimize their overall debt and prioritize federal loans over private loans whenever possible.

Loan Forgiveness and Income-Driven Repayment Plans

- Federal student loans, including Direct Unsubsidized Loans, may be eligible for loan forgiveness programs.

- Income-driven repayment plans adjust monthly payments based on income and family size, providing flexibility for borrowers.

Understanding these options can provide relief for students struggling to repay their loans after graduation. Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), may be available for those working in certain public service jobs or participating in other eligible programs. Income-driven repayment plans can also provide more manageable monthly payments based on a borrower’s income and family size, making it easier to stay on track with loan repayment. Students should research and understand the eligibility requirements for these programs while considering them as part of their overall financial planning.

Conclusion

In summary, understanding the various types of student loans and their implications is crucial for students as they navigate the financial aspects of their education. By comparing Direct Unsubsidized Loans with other options such as Direct Subsidized Loans, Federal loans, Parent PLUS Loans, and Private Loans, students can make informed choices that align with their financial circumstances and educational goals. Awareness of interest rates, repayment plans, and potential forgiveness opportunities can significantly influence students’ borrowing strategies and overall financial health. As they embark on their educational journeys, prioritizing federal loans, exploring income-driven repayment plans, and seeking financial advice can empower students to manage their debt responsibly and work towards a stable financial future.